maine excise tax exemption

Vehicles owned by this State. The Maine Legislature passed a bill that.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

The excise tax due will be 61080.

. Home of Record legal address claimed for tax purposes. Be it enacted by the People of the State of Maine as follows. This individual is permanently assigned to the unit and station identified above is on active duty and.

100-disabled Veterans are Exempt from one Vehicle Excise Tax Title Fee and Drivers License Renewal Fee. City of Portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the Armed Forces and who are permanently. Excise tax imposed pursuant to 36 MRSA.

Sponsored by Representative Heidi Brooks. The following exemptions qualify for reimbursement. The following are exempt from the excise tax.

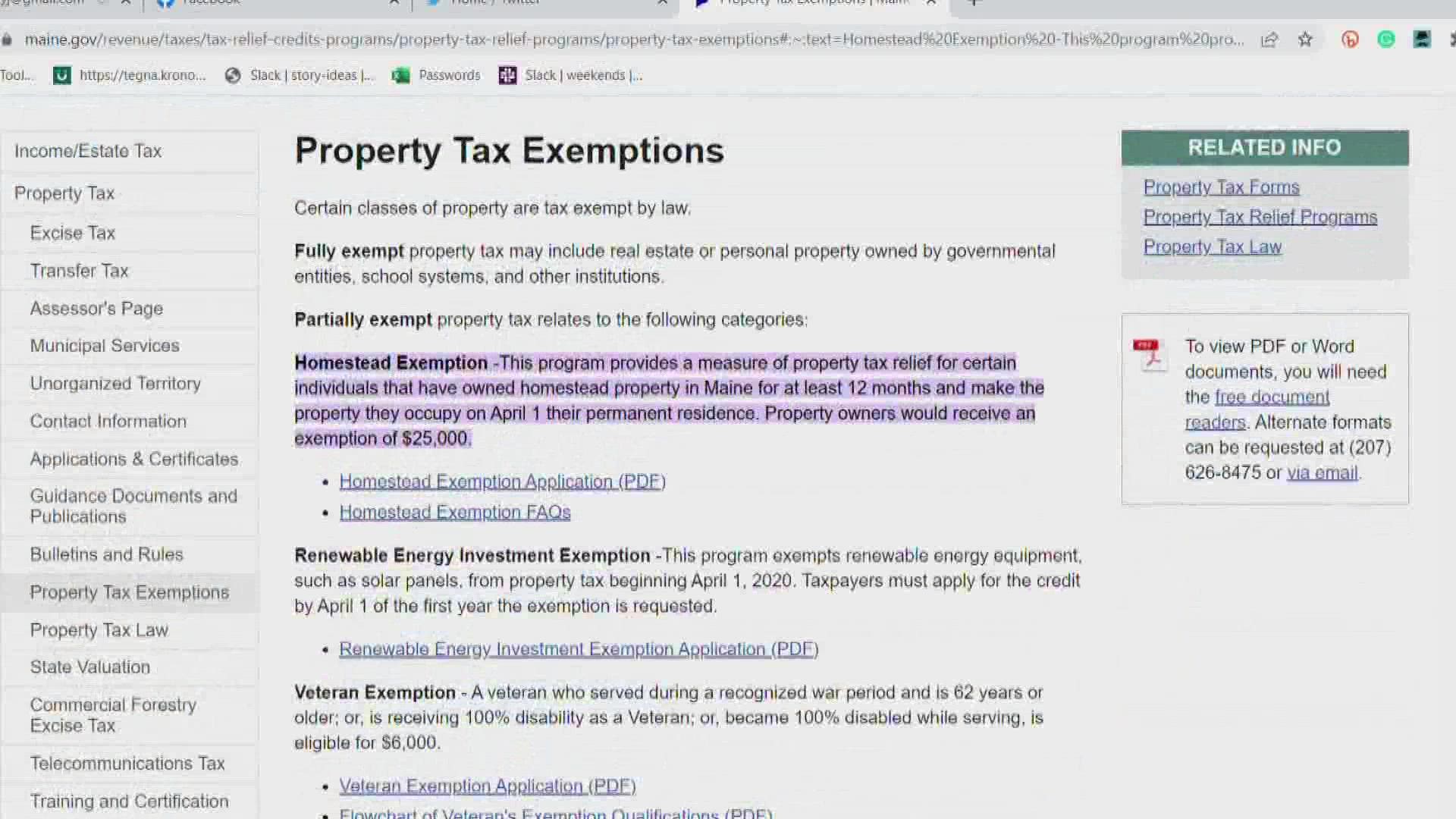

Homestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned. Animal waste facility 36 MRS. 691 - 700-B Homestead 36.

State of Maine Legislature. Maine Bureau of Veterans Services Central Office 117 State House Station Augusta ME 04333-0117. 36 MRSA 1483 sub-12 as.

Except for a few statutory exemptions all vehicles registered in the State of Maine. March 9 2022 News. LD 1355 SP 441 An Act To Amend the Motor Vehicle Excise Tax Exemption for Veterans Who Are Disabled Sponsored by.

6561J Business Equipment Tax Exemption 36 MRS. What is Excise Tax Excise Tax is an annual tax that must be paid when you are registering a vehicle. Board of Appeals Ordinance.

Summary of LD 1355. I hereby claim excise tax. To qualify for this exemption the resident must present to the municipal excise tax collector certification from the commander of.

207-626-4471 Homeless Veteran Coordination Team 207. AIRCRAFT HOUSE TRAILERS AND MOTOR VEHICLES. An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax.

LD 1193 HP 871 An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax. Comprehensive Plan Revised 2005. Maine Department of Inland Fisheries and Wildlife 353 Water Street 41 SHS Augusta ME 04333 Phone 207-287-8000 Fax 207-287-9037.

Partially exempt property tax relates to the following categories. Those sections of this Act that amend the Maine Revised Statutes Title 36 section 653 subsection 1 paragraphs C and D and enact Title 36 section 653 subsection 1 paragraph C. MAINE REVENUE SERVICES SALESEXCISE TAX DIVISION AFFIDAVIT OF EXEMPTION For purchases of electricity fuel or depreciable machinery or equipment for use in.

Adult Use Marijuana Licensing Ordinance. A registration fee of 3500.

Maine Estate Tax Everything You Need To Know Smartasset

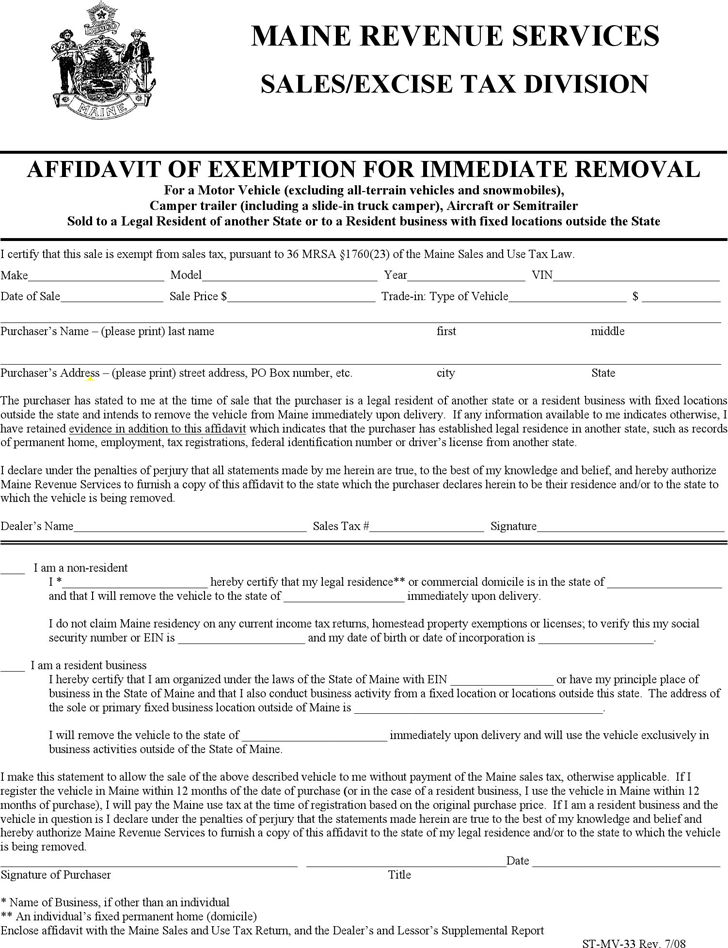

Free Maine Affidavit Of Exemption For Immediate Removal Form Pdf 35kb 1 Page S

Maine Form 1040me 2015 Fill Out Sign Online Dochub

Maine Reaches Tax Fairness Milestone Itep

I Team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

Welcome To The City Of Bangor Maine Excise Tax Calculator

Welcome To The City Of Bangor Maine Excise Tax Calculator

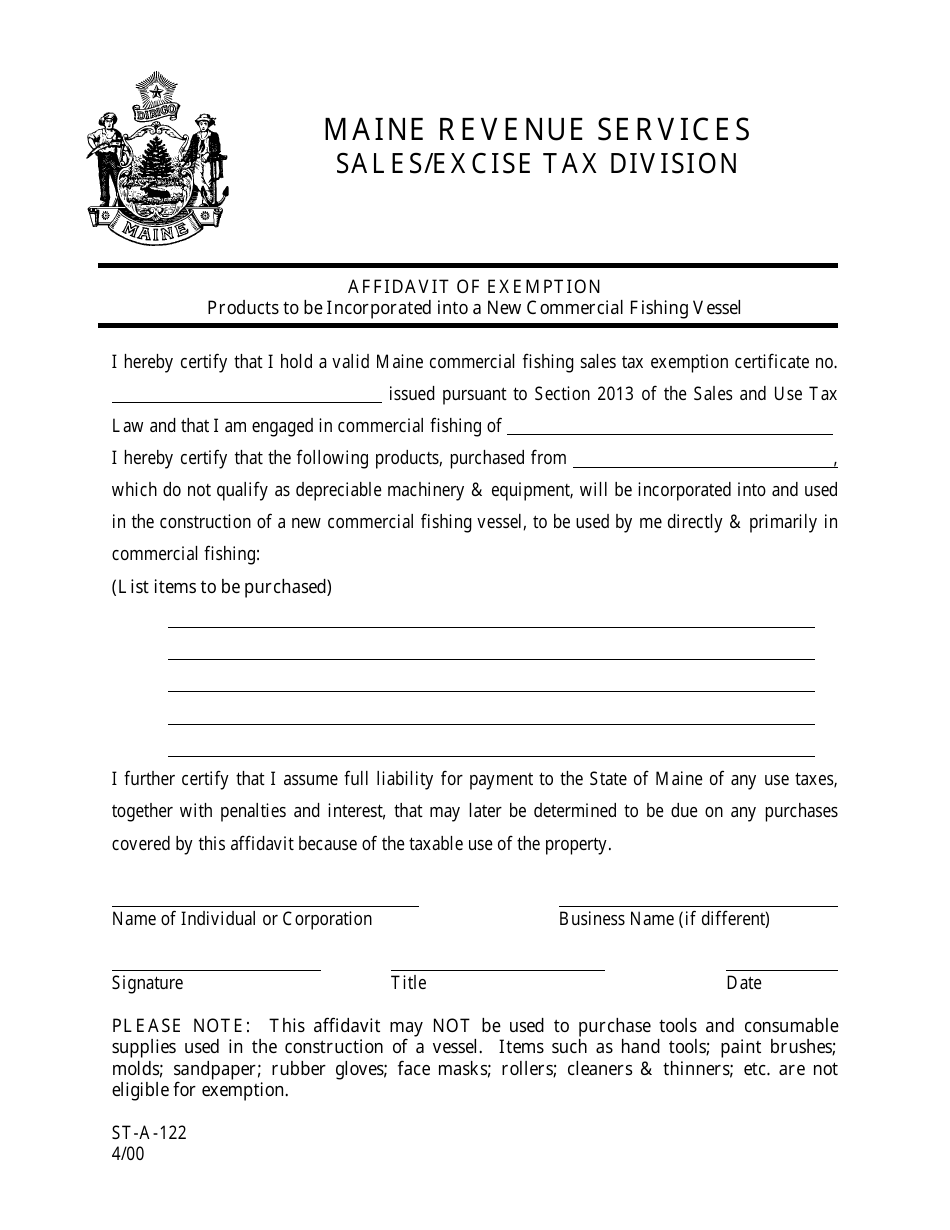

Form St A 122 Download Printable Pdf Or Fill Online Affidavit Of Exemption Products To Be Incorporated Into A New Commercial Fishing Vessel Maine Templateroller

Welcome To The City Of Bangor Maine Excise Tax Calculator

Free Maine Boat Vessel Bill Of Sale Form Pdf

Older Mainers Are Now Eligible For Property Tax Relief Newscentermaine Com

Maine Tax Conformity Bill A Step Toward Better Policy Tax Foundation

Now Accepting Online Tax Payments Finance Department

Property Tax Stabilization Program For Seniors Cumberland Me

Maine Military And Veteran Benefits The Official Army Benefits Website

Maine Who Pays 6th Edition Itep